Introduction

In the early 1980s when Sun Microsystems used to carry the slogan “The Network is the Computer” at the time it was difficult to imagine for anyone that world would come to times where we are connected through so many devices and platforms. The concept of “Cloud Computing” was initially brought to life by Eric Schmidt (ex-CEO of Google) during the search engine conference in August 2006, even though Amazon has launched “Elastic Computing Cloud Services” in March 2006. The world of cloud computing has taken less than a decade to have a global reach and have been having great momentum when it comes to growth. Not only as a technology but a technology which enables wider businesses to be more responsive to the market demand and growth.

If we summarise cloud computing evolution history, it will look something like this.

With that in mind, now let’s look at FinOps. The growth of cloud computing results in extensive usage of resources and services which are provided by the cloud providers around the globe. This means the business must be mindful of the investments which they make on technology and ensure there are tangible returns to the core business.

Understanding FinOps

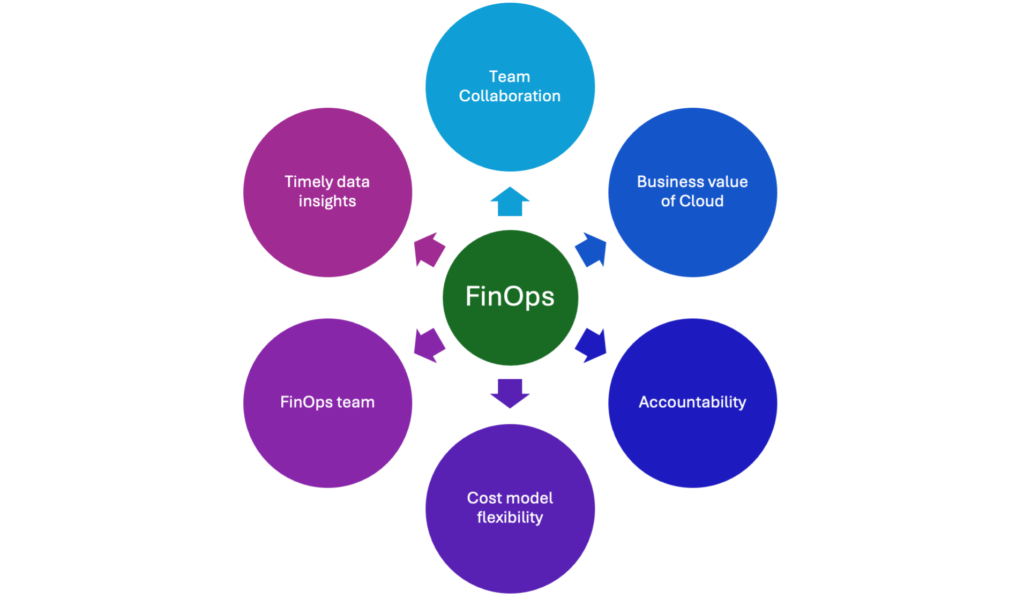

It is critical to understand what FinOps is before we start implementing it in our businesses. In essence FinOps is a framework which provides operational and cultural practices to bring better value of cloud computing to the business, enable data driven decision-making and to ensure there is accountability within the organisation across departments. While this is a very broad statement which defines the FinOps framework there are key aspects that is highlighted in the framework.

Let’s look at each of these in a little detail to better understand what they mean to the FinOps framework.

Team Collaboration

Organisations have multiple teams involved in business operations, and a sustainable practice of FinOps requires them to work together to achieve defined objectives and ensure efficient operations. For instance, an HR department using a cloud-based HRIS platform depends on the platform or engineering team, who hosts and maintains the solution. If the platform/engineering team performs maintenance activities without proper notification, it can cause business impact and financial losses. Both departments are part of the same organisation, so the loss is directly related to the organisation.

Business value of Cloud

Organisations are in many shapes and sizes across the globe which consumes cloud services and some of which are those who provide cloud computing services. Those are the likes of AWS, Microsoft, GCP etc. While majority are cloud consumers. Therefore, organisations who uses cloud computing to enable new products or services through cloud computing must ensure they gain the best business value from the cloud platforms.

Accountability

This is another important aspect for all the teams in the organisation. Whether the team is acting as the provider of the platform or the consumer of the platform every team must make sure that they are aware of the cost implications associated with the cloud service consumption. This in return helps manage the respective budgets and informed decision making.

Cost model flexibility

Financial management is crucial for any organisation, and cloud computing offers flexibility through a pay-as-you-go cost model. This allows organisations to focus on operational expenditure, reducing capital expenditure and enabling timely investments, rather than upfront investments. This flexibility is a critical factor in business success.

FinOps Team

Organisations utilising the FinOps framework need a dedicated team to promote and coordinate FinOps practices at all levels of the company. This team must get executive sponsorship and have a solid grasp of the discounts and rates associated with cloud consumption contracts. FinOps is more than simply an operational activity; it also connects with the organisation’s strategy, making it critical for enterprises to successfully execute this framework.

Timely data insights

A critical aspect of this framework is ensuring that data is provided to the relevant stakeholders to take corrective action. This also focuses on a feedback loop which helps business departments which are purely consumers of cloud services to understand the impacts of the decisions that they have made in consuming cloud services.

Industries and importance

Let us now understand how each of the above-mentioned aspects impact industries and why they are important.

Banking, Finance, Securities and Insurance Industry

This is one of the most highly regulated industries in the globe. Whether it is to host customer data or to perform a transaction there are significant number of frameworks and standards which have been put in place. The technological and business are highly regulated to safe guard the industry by the governments as it has an impact on the economy of the country. How is FinOps a critical component to this industry? With more and more organisations becoming cloud focused it is evident that understanding the traditional models of which they operated is changing from large capital investments to more focused data driven operational expenses. This is a significant change for this industry. Therefore, understanding and driving clear focus around cloud-based services and technologies is a must. BFSI industry isn’t the most agile industry in comparison to some of the others due to the regulatory needs. The agility which the cloud based services brings to the industry could create resistance from the traditional banking operations which has to be dealt as well.

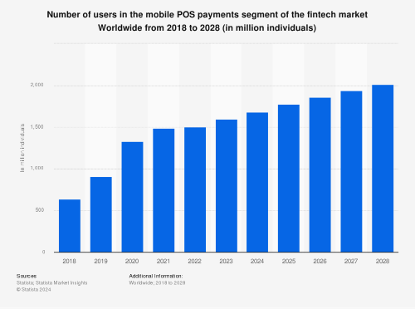

For example, majority of the banks are now having some size or shape of a mobile based application which the customers are allowed to transact. Based on a study by Statista it is showing that the market growth of mobile POS payments segment will grow significantly from 2018 to 2028.

Source: Statista 2024

This clearly showcases that cloud-computing services usage will result in further growth hence the need to establishing a FinOps in each of the organisations in BFSI is key to the success.

Retail

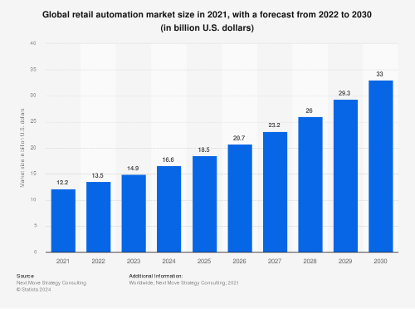

The industry vertical Retail is driven by consumers. While there are multiple contributing factors to what drives a Retail business, all retailers around the globe focus on ensuring that there is an overall good experience for consumers. Like the unprecedent growth which took place during the COVID-19 pandemic, the momentum will exist due to the recent growth in AI/ML use cases for retailers. One of such is the Global automation market as per the research conducted by Next Move Strategy Consulting.

Source: Next Move Strategy Consulting, Statista 2024

The growth which is talked about in retail industry relates to multiple use cases being implemented in retail-based organisations. The requirement to be able to deploy services which consume data services, connected devices is growing. The retail businesses extensively relies on the data which is gathered from the consumers. Therefore, the deployment of cloud-based services which are gathering data insights through IoT devices and web and mobile based applications are growing exponentially. These provide consumer insights to the business. Realtime data analysis, predictive data analysis and ability to burst infrastructure is key to the success of retail when using cloud computing. If a framework such as FinOps is not implemented within the organisation, there can be unexpected growths in the consumptions of services in cloud which will result in a direct impact to the overhead of the organisation. Therefore, the value of a retail must ensure that the overheads are managed and kept to a minimum even from a technology usage perspective.

Conclusion

The above scenarios were specific to two industries, and it can be assumed that all other industries will face the same challenges with the growth and demand for cloud computing. Hence the importance of establishment of a FinOps practice in an organisation. Tooling itself will not suffice in creating the practice and it will need to be mixed with people and processes as well. In summary for a successful implementation of FinOps in an organisation, there needs to be People, Practice, Process and Technology combined.